Crude Oil Production Cost Analysis Report 2025 Edition: Industry Trends, Capital Investment, Price Trends, Manufacturing Process, Raw Materials Requirement, Operating Cost, and Revenue Statistics

Report Overview

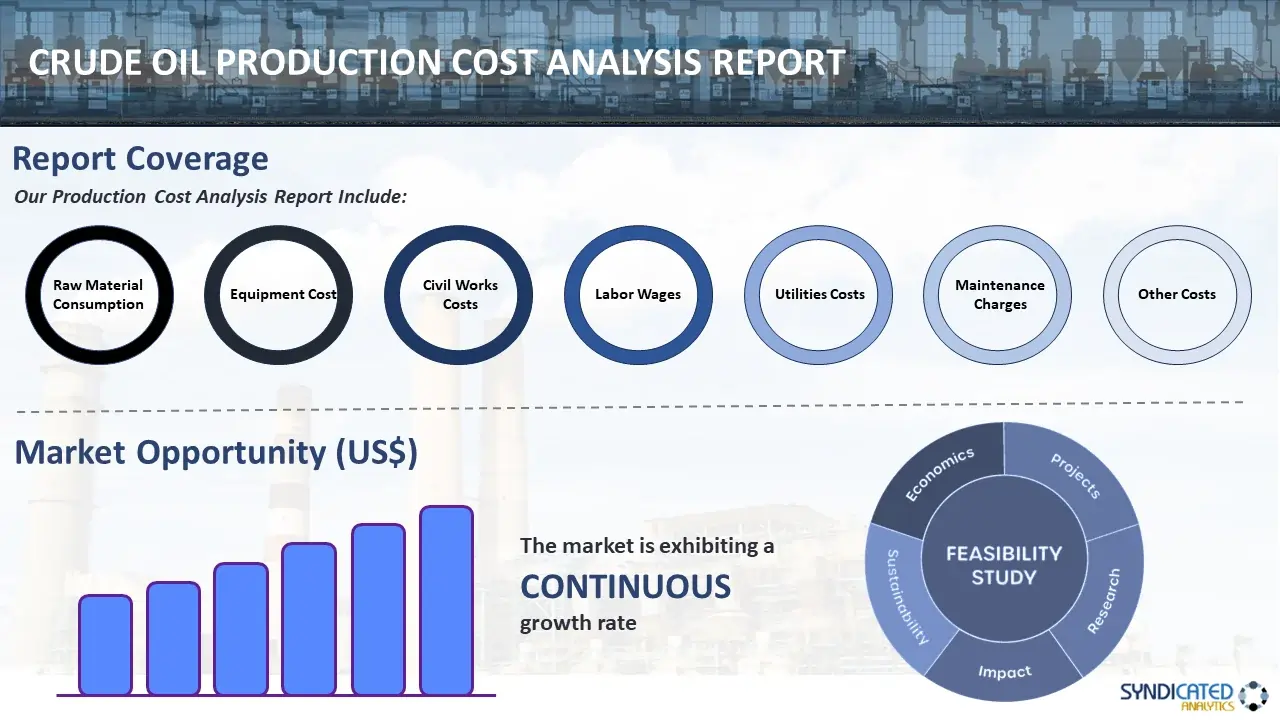

The report by Syndicated Analytics, titled “Crude Oil Production Cost Analysis Report 2025 Edition: Industry Trends, Capital Investment, Price Trend, Manufacturing Process, Raw Materials Requirement, Operating Cost, and Revenue Statistics,” presents an exhaustive analysis of both the operational expenses and revenue projections for setting up a crude oil manufacturing facility. Resulting from thorough primary and secondary research efforts, this document offers an in-depth exploration of market dynamics and the effects of the COVID-19 pandemic at both global and regional scales. The study meticulously examines price fluctuations, the balance of mass against required raw materials, and the critical unit operations essential to the crude oil production process. A detailed assessment of capital expenditures is provided, encompassing the breakdown of expenses related to raw materials, utilities, labor, packaging, transport, land acquisition, construction, and equipment. Additionally, the report forecasts profit margins and suggests strategies for setting optimal product prices. For those considering entering the crude oil market or current stakeholders, this report serves as a vital tool.

Introduction

Crude oil is a naturally occurring liquid petroleum product mined from various porous rock formations in the earth’s crust and refined to manufacture jet fuel, gasoline, and other petrochemicals. It comprises deposits of hydrocarbons and other organic substances formed from the remains of dead plants and animals that existed millions of years ago. It is refined and separated into mixtures that are further broken down into simpler fractions to be used as fuels, lubricants, and even intermediate feedstock for the petrochemical industry. Since it is a primary source of energy production, crude oil is currently gaining immense traction across the globe.

Market Trends/Drivers

The global crude oil market is primarily driven by a rise in exploration activities across subsea oil and gas sites. Moreover, the escalating demand for fuel oil, especially in emerging economies, due to the surging population, increasing number of vehicles, and rapid urbanization, is positively influencing the market growth. Additionally, the discovery of new shale oil deposits and reserves across the globe is acting as another major growth-inducing factor. Besides this, the expanding use of digital oilfield technology, including high-performance drill bits, advanced electrical submersible pumps, and 3D seismic imaging and reservoir modeling, to enhance oil and gas production, improve profitability, and optimize the utilization of human resources has catalyzed market growth. Apart from this, the growing usage of heavy construction equipment and commercial vehicles, such as trucks, buses, tractors, boats, trains, and electricity generators, has augmented the demand for crude oil. Furthermore, there has been a surge in the adoption of liquefied petroleum gas (LPG) as a clean energy source in households for residential heating, hot water systems, and cooking purposes due to elevating pollution levels and rising concerns about carbon emissions. In line with this, the increasing export opportunities for refinery products, such as diesel and gasoline, have propelled market growth. Other factors, including continuous improvements in extraction and refining techniques, ongoing research and development (R&D) activities, rising demand for electricity, and rapid industrialization, are also anticipated to create a favorable market outlook.

Market Analysis

This section delves into the dynamics of the crude oil market, including overview, historical and current performance, and impact of COVID-19. It examines factors driving demand, identifies key market trends, and analyzes the price trend. This analysis provides stakeholders with critical insights into market opportunities and challenges.

| Market Overview | Provides a broad introduction to the crude oil market, including its definition, applications, and the role it plays in various industries. |

| Historical and Current Market Performance | Examines the market's development over time, highlighting trends, growth patterns, and significant changes in the market landscape. |

| Impact of COVID-19 | Analyzes the effects of the global pandemic on the crude oil market, including disruptions in supply chains, changes in demand, and long-term implications. |

| Market Forecast | Projects the future trajectory of the market based on current data, trends, and potential future developments. |

| Market Breakup by Segment | Segments the market based on product types, applications, or other relevant criteria, providing detailed insights into each segment's performance and prospects. |

| Market Breakup by Region | Discusses the market's geographical distribution, analyzing key regions and countries in terms of market size, growth opportunities, and challenges. |

| Price Trend | Crude Oil Price Trend: Examines the historical, current, and forecasted price trend of crude oil. Product Margins: Discusses the profitability and margins associated with crude oil production and sales. |

Crude Oil Manufacturing Process

The manufacturing process segment offers a detailed overview of the production of crude oil, highlighting the technological methodologies employed, from raw material procurement to the final product. It outlines the sequence of operations involved and the equipment used, offering a comprehensive understanding of the manufacturing lifecycle.

| Product Overview | This section introduces crude oil, outlining its properties, applications, and significance in various industries. The overview establishes a foundational understanding of the product's role and value in the market. |

| Detailed Process Flow | A comprehensive depiction of the crude oil manufacturing process, from raw material intake to final product packaging, is provided. This includes a step-by-step guide through each stage of production, emphasizing critical control points and technological considerations. |

| Various Types of Unit Operations Involved | An examination of the unit operations integral to the manufacturing process. This segment delves into the technical aspects of each operation, detailing the equipment and methodologies employed. |

| Mass Balance and Raw Material Requirements | An analysis of the mass balance within the production process, highlighting the input of raw materials and output of final products and by-products. This section quantifies the raw materials required for a defined production volume, facilitating resource planning and optimization. |

Production Cost Analysis

This part of the report scrutinizes the various costs associated with the production of crude oil, including raw material costs, utilities, labor, and overheads. It breaks down the plant costs into detailed categories, providing an in-depth look at the factors contributing to the total production cost and their implications on pricing and profitability.

| Currency | US$ (Information can also be provided in the local currency) |

| Pricing and Purchase Options | Single User License: US$ 3450 Five User License: US$ 4450 Corporate User License: US$ 5450 |

| Customization Scope | The report can also be customized based on the requirement of the customer |

| Post-Sale Analyst Support | 12-14 Weeks |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report?

- What are the various unit operations involved in manufacturing crude oil?

- What are the raw material requirements and costs in manufacturing crude oil?

- What are the utility requirements and costs in manufacturing crude oil?

- What are the manpower requirements and costs in manufacturing crude oil?

- What are the packaging requirements and costs in manufacturing crude oil?

- What are the transportation requirements and costs in manufacturing crude oil?

- What are the land requirements and costs in manufacturing crude oil?

- What are the construction requirements and costs in manufacturing crude oil?

- What are the profit margins in crude oil?

- What should be the pricing mechanism of crude oil?

Seeking a Tailored Project Report?

While we have endeavored to create a comprehensive report, we acknowledge that each stakeholder may possess unique requirements. In light of this, we offer the option to customize the report to align with your specific needs. You can convey your business specifications to our consultants, and we will furnish you with a personalized scope tailored precisely to your requirements. Some of the common customizations that our clients often request include:

- Tailoring the report to suit the country/region where you intend to establish your plant.

- Adapting the manufacturing capacity of the plant to meet your specific needs.

- Customizing machinery suppliers and costs to align with your requirements.

- Incorporating any additional elements into the existing scope as per your specifications.

Why Choose Syndicated Analytics:

- Our reports offer valuable insights to stakeholders, enabling them to make informed business decisions confidently.

- We maintain a robust network of consultants and domain experts spanning over 100 countries across North America, Europe, Asia Pacific, South America, Africa, and the Middle East.

- Our extensive database includes equipment and raw material suppliers from major continents, ensuring comprehensive coverage.

- We diligently track and update critical factors such as land costs, construction costs, utility expenses, labor costs, and more, across more than 100 countries worldwide.

- Syndicated Analytics is the trusted partner of choice for leading corporations, governments, and institutions globally. Our clientele ranges from small startups to Fortune 500 companies.

- Our dedicated in-house team comprises experts in various fields, including engineers, statisticians, modeling specialists, chartered accountants, architects, and more. They play a pivotal role in developing, expanding, and optimizing sustainable manufacturing facilities worldwide.

Purchase Options

Ask For Customization

Personalize this research

Triangulate with your own data

Get data as per your format and definition

Gain a deeper dive on a specific application, geography, customer or competitor

Any level of personalization

Get in Touch

Call us on

US: +1-213-316-7435

Uk: +44-20-8040-3201

Drop us an email at

sales@syndicatedanalytics.com